China’s Slow down Blues- rate cut announced

On May 9th China’s central bank has cut interest rates for the third time in six months in a bid to counter an economic slowdown and ease debt pressures. The decision reflected mounting concerns over the slowing Chinese economy and growing debt problems arising from lower inflation.

In its official statement, the People’s Bank of China (PBOC) said the country’s economy was “still facing relatively big downward pressure. At the same time, the overall level of domestic prices remains low, and real interest rates are still higher than the historical average.”

In one of its starkest warnings about the pile up of debt resulting from measures to counter the effects of the 2008–2009 financial crisis, the PBOC said “rising debt size is forcing China to use a lot of resources in repaying and rolling over debt.”

In the five years following the global financial crisis, Chinese credit expanded by an amount equal to the size of the entire American financial system. But now the need to reduce this debt mountain is restricting the capacity of the central government to use fiscal measures to boost the economy.

At the same time, the Chinese economy is being hit by the general slowdown in the major capitalist countries.

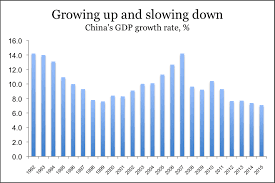

Chinese economic data for April showed a marked decline in trade as well as a lower than expected inflation rate. Exports dropped 6.4 percent for the month, following a 15 percent fall in March. Predictions had been for a rebound in April, so the continued fall has raised concerns over whether the predicted growth rate of 7 percent—the lowest in more than two decades—is going to be met.

Imports, a large component of which comprises semi-finished goods entering their final stage of manufacture in China, plummeted by 16.2 percent for the month, pointing to a slowdown in factory output.

The interest rate cuts and the easing of the reserve requirement ration (RRR) five times in the past six months have prompted concerns among some financial analysts that the slowdown in the Chinese economy is proceeding faster than government and financial authorities have anticipated.

Further cuts are expected in the not-too-distant future, with predictions that the bank rate could drop from its present level of 5.1 percent to 4.6 percent.

In another sign of growing financial problems, the central bank is reportedly considering measures that would allow local governments to restructure their debts. Local government authorities have been at the centre of the land and property bubble which has formed a significant component of Chinese economic growth over the past five years.

The real estate market, together with construction and related industries, accounts for a quarter of China’s gross domestic product and is described as “sluggish.” Bad debts are also on the rise. Non-performing loans rose from 140 billion Yuan at the beginning of the year to almost 983 billion Yuan ($200 billion) at the end of March. It was the biggest quarterly rise in more than a decade.

As has taken place everywhere else in the world, the rate cuts by the central banks have failed to provide any impetus for investment in the real economy. Rather, the central bank’s actions in providing cheaper money have helped fuel a rapid rise in Chinese stock markets over recent months.

In a statement last week, the Communist Party Politburo emphasised the need to “more efficiently channel monetary policy to support the real economy.” But the government is discovering the capital and the flow of money is not determined by “Chinese characteristics,” but operates according to its own laws.

More than $300 billion has left China in the last six months, according to estimates by the Royal Bank of Scotland mostly because of fears of mounting financial problems within China. These outflows could well increase in coming months, exacerbating China’s growing economic and financial difficulties.

-

CHINA DIGEST

-

ChinaChina Digest

China’s PMI falls for 3rd month highlighting challenges world’s second biggest economy faces

ChinaChina Digest

China’s PMI falls for 3rd month highlighting challenges world’s second biggest economy faces

-

ChinaChina Digest

Xi urges Chinese envoys to create ‘diplomatic iron army’

ChinaChina Digest

Xi urges Chinese envoys to create ‘diplomatic iron army’

-

ChinaChina Digest

What China’s new defense minister tells us about Xi’s military purge

ChinaChina Digest

What China’s new defense minister tells us about Xi’s military purge

-

ChinaChina Digest

China removes nine PLA generals from top legislature in sign of wider purge

ChinaChina Digest

China removes nine PLA generals from top legislature in sign of wider purge

-

-

SOUTH ASIAN DIGEST

-

South Asian Digest

Kataragama Kapuwa’s arrest sparks debate of divine offerings in Sri Lanka

South Asian Digest

Kataragama Kapuwa’s arrest sparks debate of divine offerings in Sri Lanka

-

South Asian Digest

Nepal: Prime Minister Dahal reassures chief ministers on police adjustment, civil service law

South Asian Digest

Nepal: Prime Minister Dahal reassures chief ministers on police adjustment, civil service law

-

South Asian Digest

Akhund’s visit to Islamabad may ease tensions on TTP issue

South Asian Digest

Akhund’s visit to Islamabad may ease tensions on TTP issue

-

South Asian Digest

Pakistan: PTI top tier jolted by rejections ahead of polls

South Asian Digest

Pakistan: PTI top tier jolted by rejections ahead of polls

-

Comments